Black Swan

CHEER UP... IT”S NOT THE END OF THE WORLD, Edinburgh Festival Exhibition, Edinburgh Printmakers, Edinburgh

BLACK SWANS AND BEAR MARKETS

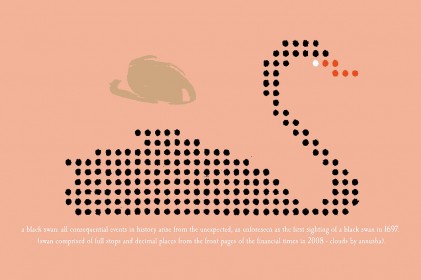

A Black Swan

Although we are all still inextricably entangled within the Banking crisis today, it was 2008’s financial meltdown that was first described as a ‘Black Swan’ year.

Financial investors irrational bias towards optimism, was seen as naïve and ill-conceived as the old belief that all swans were white.

Indeed all events in history arise from the unexpected, as unforeseen as the first sighting of a Black Swan in Australia in the 17th century.

‘…the metaphorical birds have become shorthand for any improbable sightings and unpredictable phenomenon – ever since the (first) sightings…astounded northern hemisphere twitchers in 1697.

…John Stuart Mill first used the waterfowl to demonstrate the fallacy of drawing conclusions from a series of apparently consistent data…“ No amount of observations of white swans can allow the inference that all swans are white… the observation of a single black swan is sufficient to refute that conclusion.”

Matthew Vincent ‘Black swans come home to roost’ FT 31.01.09

Faithfull’s image of the black swan is comprised of ‘pixelated’ dots, sourced from the actual decimal ‘points’ from the footsie (FTSE) listings, printed on a front page of the Financial Times during the crisis in 2008 . The pink colour background additionally represents the familiar pink colour of the FT’s pages. The golden storm clouds herald the next misguided optimistic run on the share market, just over the next horizon.

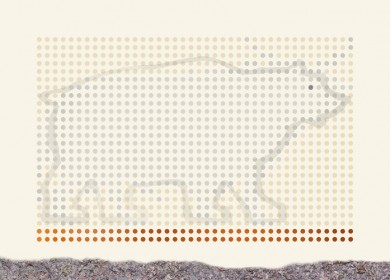

Bear Market:Bull Market

The ‘Bull/Bear Market’ project was originally commissioned by the Bank of Scotland in 2007 and investigates the financial world, particularly the share markets, incorporating actual shredded money from discarded and withdrawn Bank of Scotland bank-notes. The subject matter reflects the fiscal worlds’ relationships with ‘Bull’ and ‘Bear’ motives and markets, represented as the two animals, in pixelated 'coin' and outline forms.

These two zoomorphic forms echo or shadow of each other, describing the constant ebb and flow of these volatile financial markets and predicting each market's antithesis.

|

|